does florida have state capital gains tax

People also ask what is the capital gains tax rate in Florida. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The good news is that the Texas cap on capital gains is 15.

The state of FL has no income tax at all -- ordinary or capital gains. State tax rates vary If youre married and can exclude up to 500000 of gain you wouldnt owe any tax. New York local tax.

Texas has a 0 state capital gains tax. More specifically capital gains are treated as income under the tax code and taxed as such Here is what the states without a capital gains income tax told me. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida.

Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. Individuals and families must pay the following capital gains taxes. Florida Capital Gains Taxes.

The rate reaches 65. Property taxes in Florida have an average effective rate of. Floridas state sales tax is 6 and with local sales tax ordinances the total sales tax can climb as high as 85.

Florida does not have an inheritance tax also called a death tax. This separates them from the yearly earned income of the taxpayer. The tax rate is about 15 for people filing jointly and incomes totalling less than.

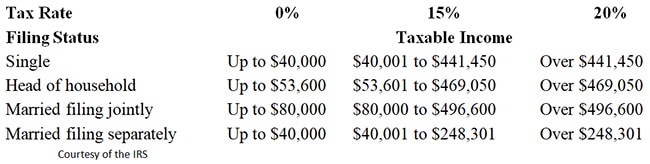

There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term capital gains. If your taxable income is less than 40400 for single filers or. This amount increases to 500000 if youre married.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. New York state tax. Income over 40400 single80800 married.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. If you are in the 396. The state taxes capital gains as income.

Affordable Care Act tax. Do all states have capital gains tax. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

States That Tax Capital Gains A majority of US. At what age do you stop paying property taxes in Florida. If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes.

Capital gains taxes can be tricky when investing especially when you have to figure out both. 50000 X 00685 3425. If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15.

Section 22013 Florida Statutes. 50000 X 003648 1824. 50000 X 0038 1900.

Includes short and long-term Federal and. Ncome up to 40400 single80800 married. Special Real Estate Exemptions for Capital Gains.

Florida does not assess a state income tax and as such does not assess. States have an additional capital gains tax rate between 29 and 133The rates listed.

Florida Real Estate Taxes What You Need To Know

Capital Gains Tax Calculator 2022 Casaplorer

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

2021 Capital Gains Tax Rates By State Smartasset

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

State Taxation As It Applies To 1031 Exchanges

How Much Tax Will I Pay If I Flip A House New Silver

2021 Capital Gains Tax Rates By State Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The States With The Highest Capital Gains Tax Rates The Motley Fool

How Do State And Local Individual Income Taxes Work Tax Policy Center